Abhishek Logani: We look at the India’s evolving travel landscape. I heard everyone talking. Let’s look at the big picture first and then see the short-term headwinds.

Let’s talk about the big picture first and how you look at the next couple of years. While we do get impacted by the immediate challenges, we have seen some ups and downs in the first quarter. But do you believe or do we at MakeMyTrip believe that it is the golden decade which everyone is talking about?

Rajesh Magow: Why should we be optimistic about it? There has to be a reason about it, it can’t be just intuition. It has to be backed by some serious macro data that we should all feel bullish about it or optimistic about it. So, let’s start with the first data point that I wanted to share.

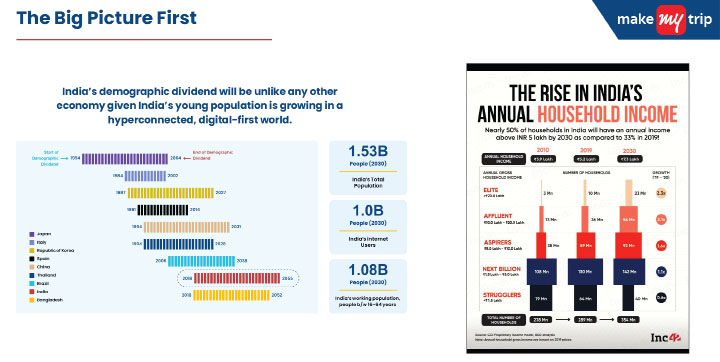

I think the biggest one that we should all keep in mind just from a macro standpoint, like macro economy, factor is the demographic dividend. Demographic dividend is nothing but the working population. Working population drives the economy from a consumption standpoint. And that’s going to be huge. The most important part here is, as we keep listening to and we’ve been, and it’s been a while, right, that we’ve been listening that India has been doing better than the rest of the world. One single biggest reason for that is this dividend that we have. Because if you see that left-hand side chart and see various other countries, every country seems to be losing their dividend very, very fast now, which is becoming India’s advantage. The other way of putting that is India is evolving, we were an underdeveloped economy, getting to a developing economy, or emerging economy, it is basically stages of evolution of the economy only.

But this is the one that is going to drive, and you would see Bangladesh by the way, just behind us in terms of when will the demographic dividend is likely to end. And then there is Brazil. China is just another five years ago. Now China was a great story and I know China is a bad word, but China was a great story three decades ago, two decades ago and increasingly now losing the demographic dividend. So no matter what happens, this is going to stay. And all of this what I am going to talk about at least in the first section by the way is going to be a really longish term outlook. It is not necessarily here and now. And we’ll talk about here and now, which is the second part of the conversation, that how do we see headwinds from a short-term perspective and how should we possibly deal with it.

And the other thing that you see along with that on the right-hand side is also equally important and that is a direct function of overall GDP growth that is happening, that the incomes are rising. But we must understand how incomes are rising and how the consumer cohorts are going to behave. And for that, this data point is very, very important. And you may have heard that a lot of people talk about a per capita income benchmark as an inflection point. And I just saw a video day before yesterday. And on WhatsApp, you know there is all kind of stuff that goes on. Except for the number, everything else was right. I think in that, the number was being talked about per capita income of $3,000 is going to change the game, that I am not sure is true, especially for our industry. But what is definitely going to change the game is going to be between $5,000 to $10,000 and more so, more than $10,000 annual income. And that is significant cohort and growing. And this is 2019 data and projections for 2030. If you would look at these numbers, these are sizable number of households, which effectively means on an average per household number, if you take four members, there are going to be multiplication of four consumers or the people who would be spending that household money.

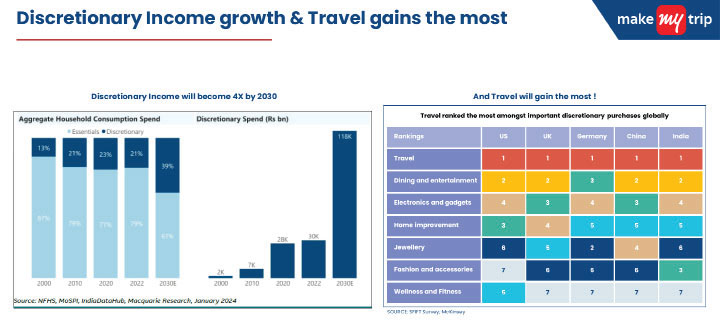

And today, and this is 2019 data, but if I take today’s data, that household between 5000 to over 5000-dollar number rather, annual income is about 75 million households, roughly or between 75 to 100 million households, which effectively means about 350 to 400 million people. That’s going to grow to about 170 million households by 2030. And more than 10,000-dollar income, annual income household is going to be about 75 million. Now that is where the discretionary spend lead industries would grow. And it’s going to, and I don’t think if there is anything, if the demography dividend is going to play out, of course, everything is going to be a function of executing it well. We and if we don’t end up messing on the execution on all fronts of the economy, including the reforms, this is going to stay and the incomes are going to rise. The growth rate is going to be 6%. In fact, I was reading one economist the other day. And he was saying the real issue is not about 6% hitting the 6%. The real issue is if we want to be ambitiously meet the 2047 goals defined by the country, then it has to be an 8% growth. And for 8% growth, you need the next level of reforms across the board. And if we don’t end up doing reforms across the board, which is the part of the execution, then we will suffer. Now, those are the kind of issues that could emerge. But all of that is going to be more related to what are we going to do, how are we going to do, more in the execution domain rather than sort of macro factors. You will see the discretionary income changing and people are just going to, out of the total income, if it is 80-20 today in favor of essentials, it’s going to become 60-40. So, 40% discretionary income of the total income, imagine what can potentially happen. And now marry that with the next graph, that is a 2025 survey globally. Travel turned out to be the number one item where the discretionary spend is getting spent today. This tells you today’s trend. So if you bring all of this together, these are all obviously positive signs on the demand side, which is very, very important. Now, this one is more an interesting trivia and this will just give you an indication of what’s happening.

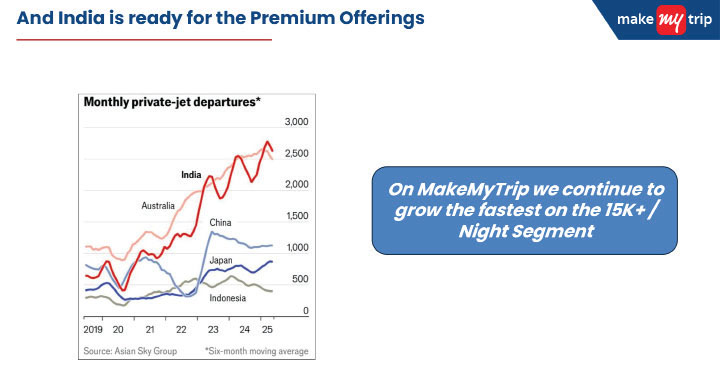

I don’t know if anybody can take a wild possible guess on the US private market? In terms of just, you know, go wild in your imagination and say how many x more from this number? It’s a 105x of this number. So it’s just crazy. Now, US is an extreme example because it’s a massive number of airports, massive number of wealthy people, if you will, and therefore private jets. But it only gives you the direction which India is sort of going towards. So I think we should keep that in mind.

Now let’s come to the supply side. Just couple of data points on the supply side given that we are also talking about travel and tourism. I know the previous panel was talking about a lot of noise in this industry. It is a phenomenon of every sector, every industry. So, if let’s say, if you see the announcements, which might be exaggerated today in the hospitality industry, maybe hospitality industry is just catching up with that. But if you look at aviation historically, worldwide, you will see headlines of all the time of record orders, all the time. There is no one year where you will not hear the announcement of world record orders if nothing more. And it’s a phenomenon.

And I think over the years, all the industry serious players, they figure out their own way of analysing the data with a little bit of a pinch of salt and invariably you would realize across the sector, by the way our sector was not any different. I mean given that Micomotorpe has a 25 years journey and I had the opportunity to get connected with a lot of the other non-travel e-commerce companies as well, for the last 25 years, there has been tremendous amount of noise, there has been tremendous amount of capital flown in into the sector. People talking about building long term sustainable businesses forever. The venture capitalists thought that the exit could be maybe five years within five years, we will make a ton of money, they’re still making in some 15 years or 20 years. So invariably, what happens is that you made a point and someone made that point, a very important point. I think it just boils down to timing. Not that it’ll not happen. It’ll 100% happen, given that the macro drivers are there.

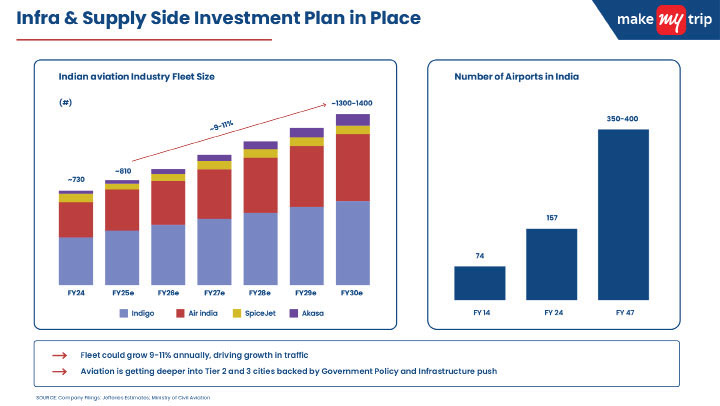

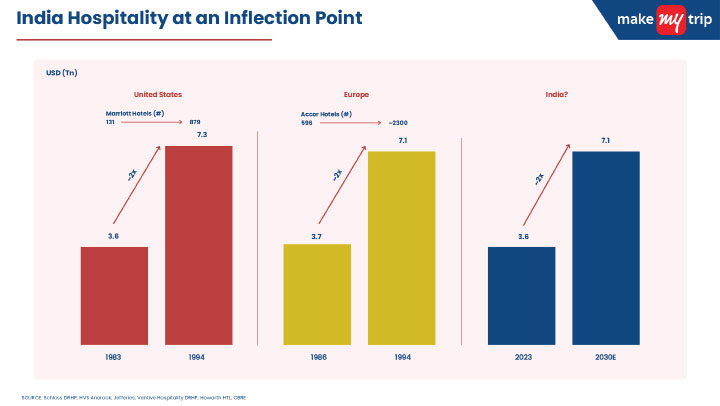

It might not be, I would say 2030 projection, it might be 2035 projections. On actual execution, it might just get delayed but it will 100% happen. And I think that’s the only difference that plays out invariably in every industry. So, you look at the orders, we take it with a pinch of salt also, the, you know, all orders put together on aviation front for example, which is the lead indicator in our industry always. In 2024, if it was 700 odd fleet size, it’s going to be 2x fleet size by 2030. If you look at number of airports, crazy numbers in 20 years, again, we will be like phenomenally growing. And similarly, and the next one is even more interesting. In the hospitality sector, this is an analogy of US, Brand Marriott, and then Europe, and then India. Very interesting correlation in how, correlation in GDP growth, and then the brand growing along with it. And these are actual numbers because that’s history as far as US and Europe is concerned. And you will see it is either 9 years or 8 years and in India’s case we are talking about 7 years and maybe in India’s case it may not be 7 years, it might be 10 years. The GDP was growing 2x and phenomenal growth in the brand size.

And at least our belief is that and it is going to happen exactly the same way in India. And therefore, if I look at some of the publicly declared numbers, let’s say IHCL, for example. Currently, how many hotels are there? So, the projection is from now at about 170 or so to about 700. Including Jingles to about 700. So, it’s the 2030 projection, very similar to what we have. Very similar to this kind of trend.

So if you look at just the projection, now whether that happens by 2030 or it happens by 2032 or 2035, doesn’t matter. And maybe 700 will become 1000, who knows. It all is going to be a function of how well we are going to execute it. So, if you look at the supply side or if you look at the demand side first and you look at the supply side first and India is a supply constraint market, we all know and that is why everyone and you making noise, you are listening to rather lot of the noise and people getting very optimistic, very bullish about the projection etc. is all because of this. I think it will be fair to say that we should stay optimistic as far as long-term outlook for the country is concerned. Mostly because of all these big macro factors which are in our favour.

So, net-net it will actually be government included. If we mess it up, it is going to be squarely on us, all of us together, all the stakeholders, because the opportunity is right in front of us. If we don’t execute it well, starting from reforms to down to on the ground execution, then I don’t think we have to blame anyone else. We should be blaming ourselves.

Abhishek Logani: So overall, very optimistic. But any derailers which you see Rajesh, at least in the short term, mid term, if any?

Rajesh Magow: Yeah, yeah, clearly. And coming out of first quarter, we all faced it, right? And unfortunately, while we also enjoyed the pent up demand right after COVID, but whenever the macro factors sort of go in the wrong direction, Travel and tourism is the first one to get hit. And that’s exactly what happened, whether it was India-Pakistan escalation, the Pahalgaon attack, obviously, it started, which was extremely unfortunate. Then the tragic crash of Air India and the sentiment was really muted.

And we do measure, by the way, every month, the consumer sentiment on travel. And we’ve been doing that right from COVID days. And then you can see sudden drop that happens. The good news is that it’s sort of coming back already. As we realize and we’ve seen in the past, life goes on. Public memory is really, really short short and people start to move on.

If you really see some of the earnings that are coming out with some of the other sectors, it is sort of giving you some indication of slowdown and there’s a possibility there will be cycles. There will be slow cycles. We have learned, I think over the years in the past, how to deal with them and you will have to be pragmatic, you will have to be prudent there and manage those down cycles well because they are likely to be short, but maybe more frequently than what they used to be in the past.

On the supply side, there are headwinds, especially in the aviation sector. We can clearly see that. But we also at the same time see there are a lot of entrepreneurial spirit in India comes up with many innovative solutions as well. So we look for and I think the reason for or the compelling factor for chasing and finding, trying to find the solutions, even if there are constraints which are from two manufacturers that we have in the world, is only because of the demand. Because they see demand and they see opportunity getting missed and they would figure out whether you have to go look for other countries where there would be planes available and then you can take them on lease as one example and there are many others.

So I think supply side could be one short term headwind, on the demand side little bit of slowdown, I think it’s just you do have a tariff overhang that’s still continuing, which makes it a little bit uncertain for everyone. And then you become conscious. But I think it’s going to blow away.

Abhishek Logani: I think the good part, at least what we saw on our platform, the occupancies did taper off a bit but the good part is that kudos to everyone here, the ADR still held through, it didn’t dip actually and that shows some resilience for the hospitality industry per se. Rajeev, anything on the customer behavior which you saw over in the last quarter, you know how things moved across people not traveling or traveling more, maybe traveling outside, maybe traveling within India.

Rajesh Magow: You’ll be amazed how consumers just adapt to the situation and change. So, let’s say if a couple of things that happened in the land, whatever little silver lining was there in the last quarter, because there were headwinds from everywhere. So let’s say if the sentiment was a little muted and saying we are fearful of traveling by air, what should we do? And because we’ve got a ton of data on our platform, we saw people just taking around transport options, just picking up their own car, the short-term getaways rose significantly. The shorter sort of say travel picked up.

Last minute travel picked up hugely. People said that not that I’m going to stop traveling, not that I’m going to not go and have a relaxed time over the weekend, but maybe I will just not plan or push my sort of relatively longer term holiday plan by a quarter or so till things settle down.

Very interesting trend, like 40-50% of our business started to happen for nearby accommodation. In any case, India is a very last minute market, we are not great planners. Our APU window is relatively pretty short, but even on top of that, it became even more short. So that was an interesting trend.

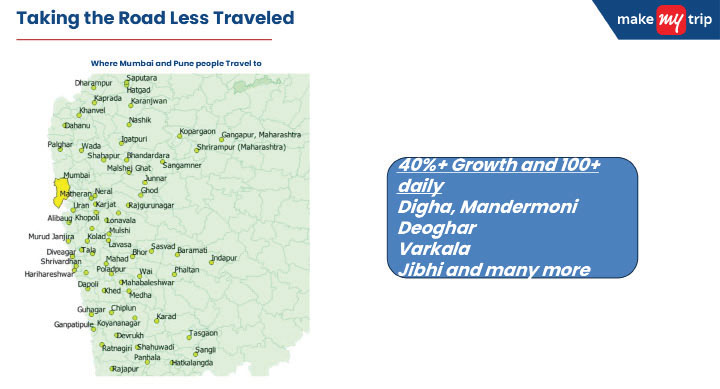

And then I think the interesting one, and you have the data points on that, is that people have started exploring newer destination. And we do see tier 1, tier 2, tier 3 because of let’s say you know more organized brand hotels and just going into the territory where nobody really was going. And you will be surprised how people are actually exploring newer destination. So therefore, I think the innovation has to be more in terms of what product will suit

that particular market and location. And I think that clearly was coming out in the last conversation as well. As against the same approach that you might end up taking in a big city versus and that’s obviously not going to work because that’s not going to be either capacity available, nor that kind of demand, or consumer interest available for some of those smaller cities.

But in terms of when you look at the dispersion, I think it’s just going to be a lot more cities in India that are going to be more interesting from or attracting more travel and tourism.

Abhishek Logani: Any quick suggestions for people sitting here before we wrap it up in terms of the last session and a quick summary of what you think.

Rajesh Magow: Actually, the kind of audience that I have in front of me, I don’t know whether I can give any suggestion to them. This is an August audience. I can see collective wisdom in this room is going to be by an order of magnitude higher than my young age, if you will.

But if there is one thing that I tell you just from, at least my observation standpoint, and I know there has been desire to accelerate the expansion really rapidly across the board in the hospitality chains. One model, and maybe I’m still trying to sort of deep dive and understand a little bit more, but I keep questioning whenever I whenever I hear about expansion happening, but following that model in this industry, I get a little bit worried I have some experience in the past before make my trip sort of operating in that sort of model and that is the franchise model. Especially in the context of Indian market and the need that the Indian market has and the perception of the hospitality, not only India, that the Asian region has in consumers mind about what kind of experience that they should sort of see when they visit hotel and any of any even alternative accommodation, even smaller accommodations, you’ll be amazed, even for a smaller budget hotel accommodation, the expectation on experience doesn’t go, it gets diluted. Obviously, it is not going to be a five star kind of an experience. But within their property, there are certain expectations.

So, I sometimes worry if we accelerate our expansion plans in the desire to monetized brand and make more money and dilute our experience on the ground or we don’t add as much value to let’s say the franchise hotel in terms of just giving more knowledge, guidance which is you know also available in abundance thanks to the experience that all the you know beautiful high scalable well- reputed growth you know high growth chains have I’m not sure that that’s going to be a long term sustainable model.

So I think that is the only thing that I’ve been and I’ve had serious conversations with at least some of the industry partners of ours. And I think that’s the only thing that I see. Otherwise, if we end up sort of being a little bit more intelligent, being more trying to see the right kind of product market fit, not necessarily, let me just give you one of the bad things that happened in the internet industry was too much capital was chasing at one point in time and they they were chasing vanity metrics, they’re just the top line traffic growth is that and the other and at least five years got lost in that and they lost a lot of money and they’ve got nothing out of it and you know and I don’t think this industry would ever end up doing it because that’s a completely different world as well. But even in the brick-and-mortar model, if we go carefully, we go intelligently, we stay optimistic and bullish, but we go intelligently and creatively to get the right product market fit and the model that should work without diluting the customer experience on the ground. I think that would be the only sort of humble suggestion that I’ll have.